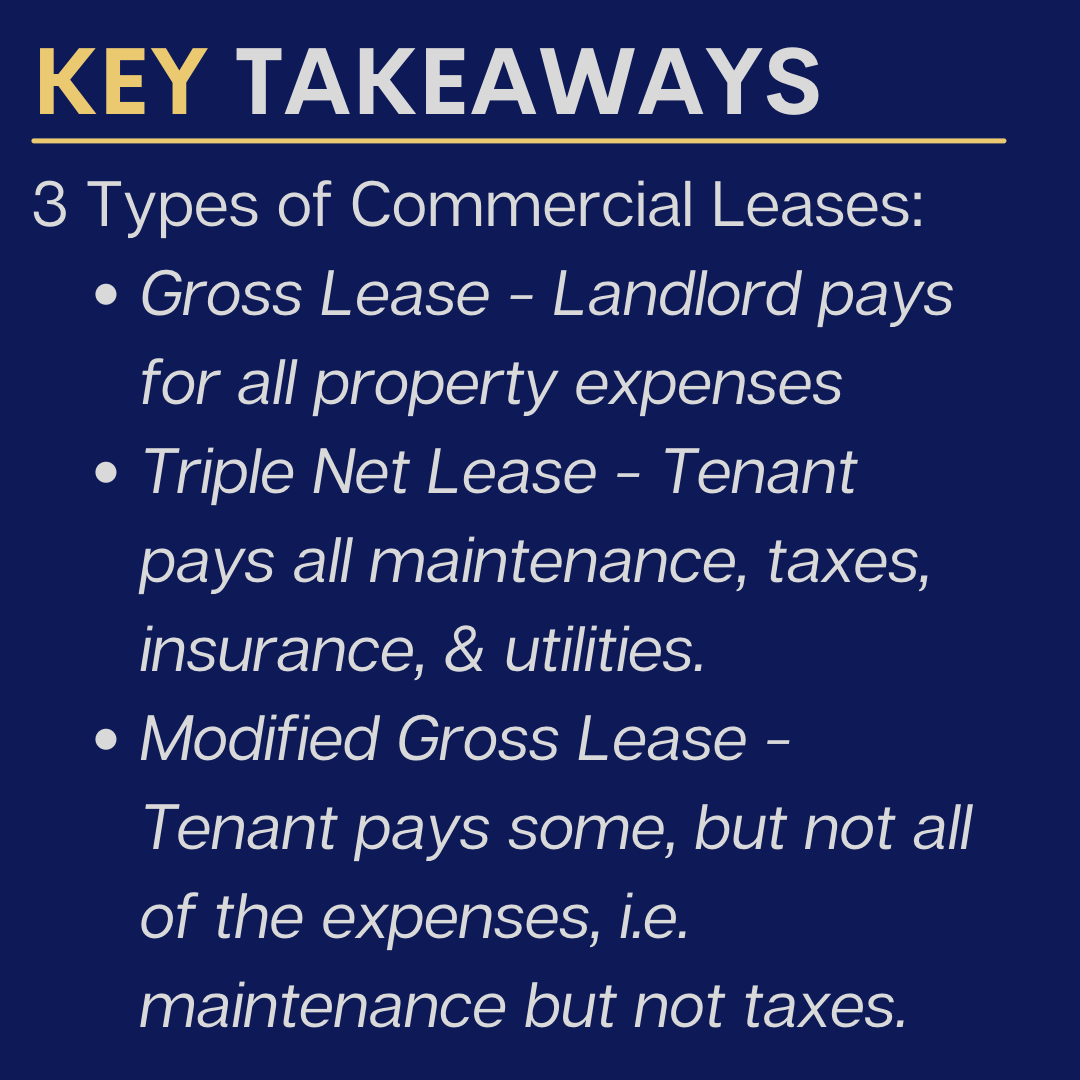

Venturing into a small business is exciting, fulfilling, and not to mention, nerve-racking. Some business owners can do it out of their homes. For others, commercial space is needed to operate their business. Whether it is for a retail store, office, or restaurant, there are many ways landlords structure a lease, and it varies from property to property. There are three main types: Gross, Triple Net, and Modified Gross Lease.

What is a Gross Lease?

As with most commercial leases, a gross lease is calculated on a price per square foot for a certain period. The lease rate includes all the property expenses, such as utilities, maintenance, insurance, and taxes. This can benefit the tenant because it is easier to budget without worrying about fluctuating energy bills and unforeseen maintenance issues. Most leases come with an escalation clause that increases the rent after a specific time. With a gross lease, the price per square foot is usually higher, but the property’s operational expense risk remains with the landlord.

What is a Triple Net Lease?

This type of lease is the opposite of a gross lease. In a triple-net lease, the tenant pays the rent as well as insurance, property taxes, maintenance, and utilities. They are usually responsible for the care and upkeep of the building and property; therefore, the tenant carries the most risk. This is the most common lease for more sophisticated tenants and landlords, such as regional and national businesses or large, well-located Shopping centers. These property expenses are called Common Area Maintenance (CAM) charges and are in addition to the rent. CAM fees are estimated each year and paid along with rent. The property manager directs these maintenance needs for common space shared by multiple tenants. At the end of the year, the parties are expected to “true up” to reflect the accurate maintenance cost. This can involve an additional payment or a refund for the Tenant. During lease negotiations, an accurate estimate of CAM charges is essential to mitigate legal and relationship risks during the lease.

What is a Modified Gross Lease?

A modified lease is a combination of gross and triple net. Depending on the landlord and the property, the rent might include property taxes and insurance but not utilities. It might consist of utilities but not maintenance. The tenant can be responsible for any combination of expenses. A tenant might see this type of lease in an office space. The tenant and landlord share the risk with this type of lease.

It is essential to read through the agreement documents with every lease carefully. The tenant needs to understand their responsibilities as well as the landlords. Working with a commercial real estate professional can help business owners get the best terms and conditions for their needs. This allows the tenant to focus on its mission and grow the business.